Money Saving Challenge

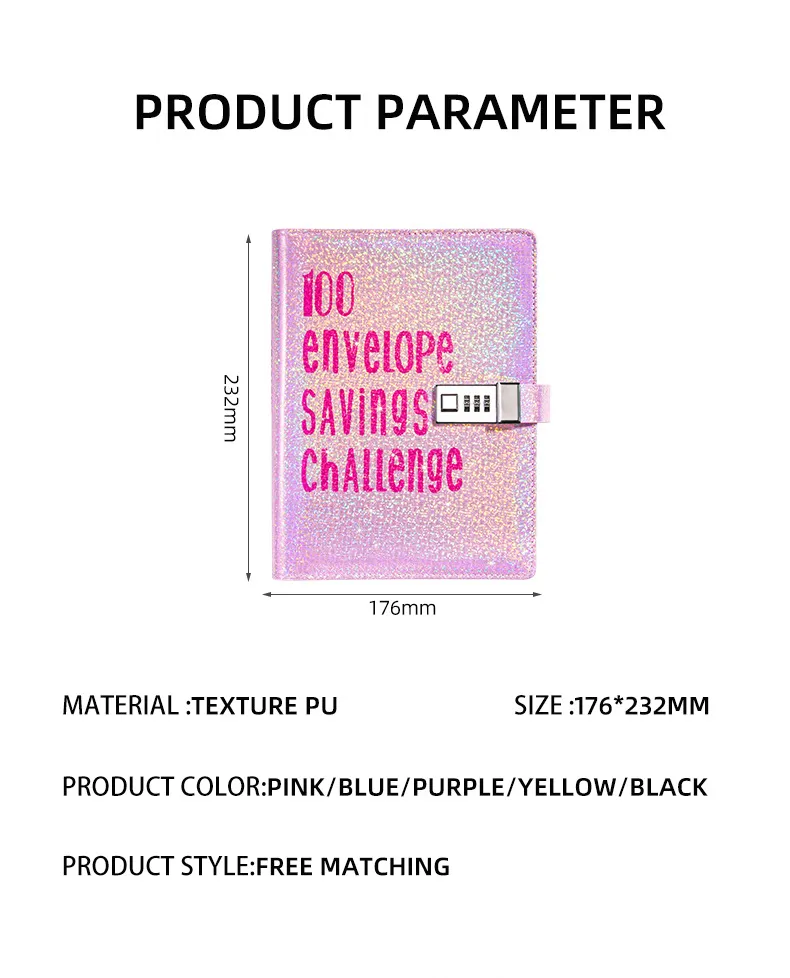

Product Information:

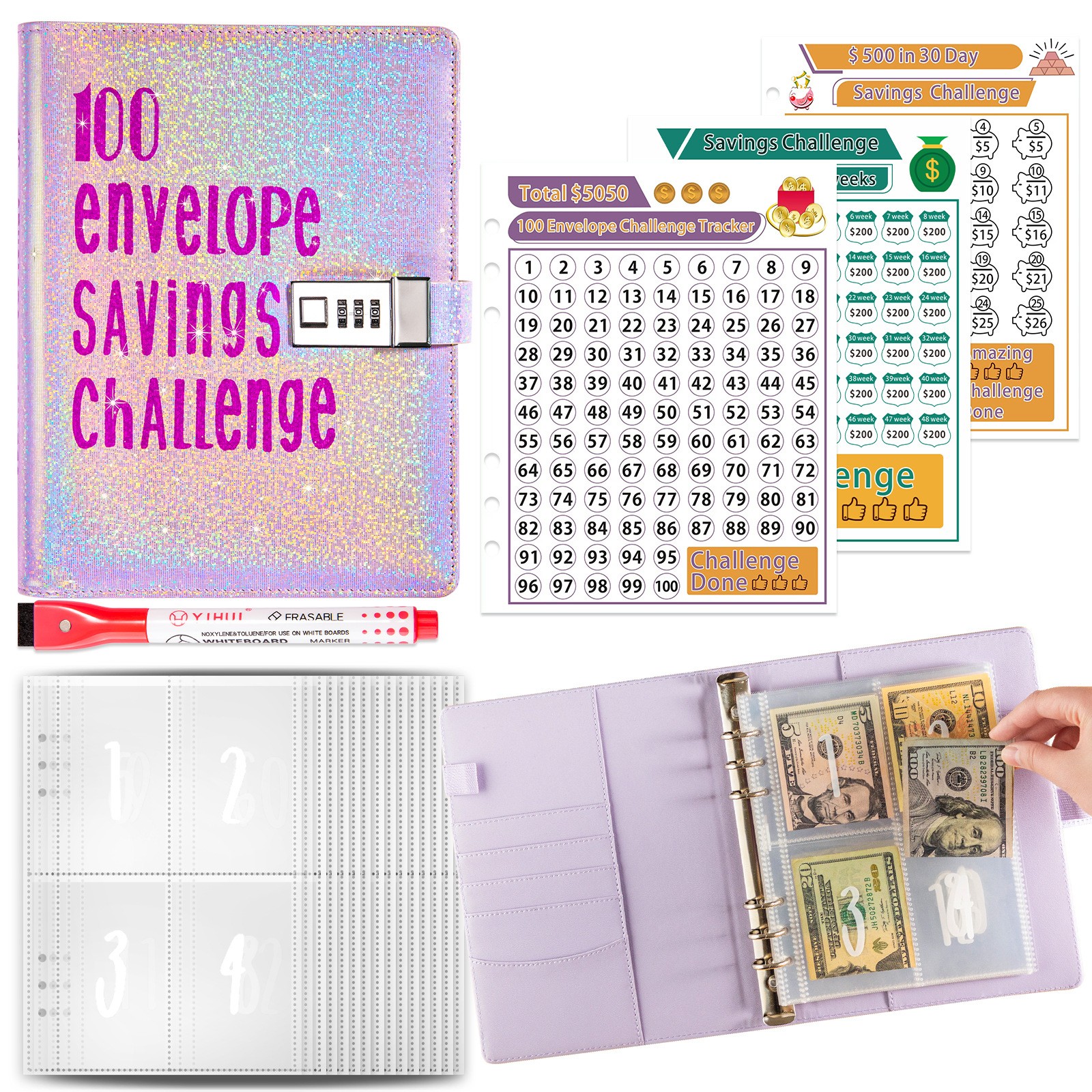

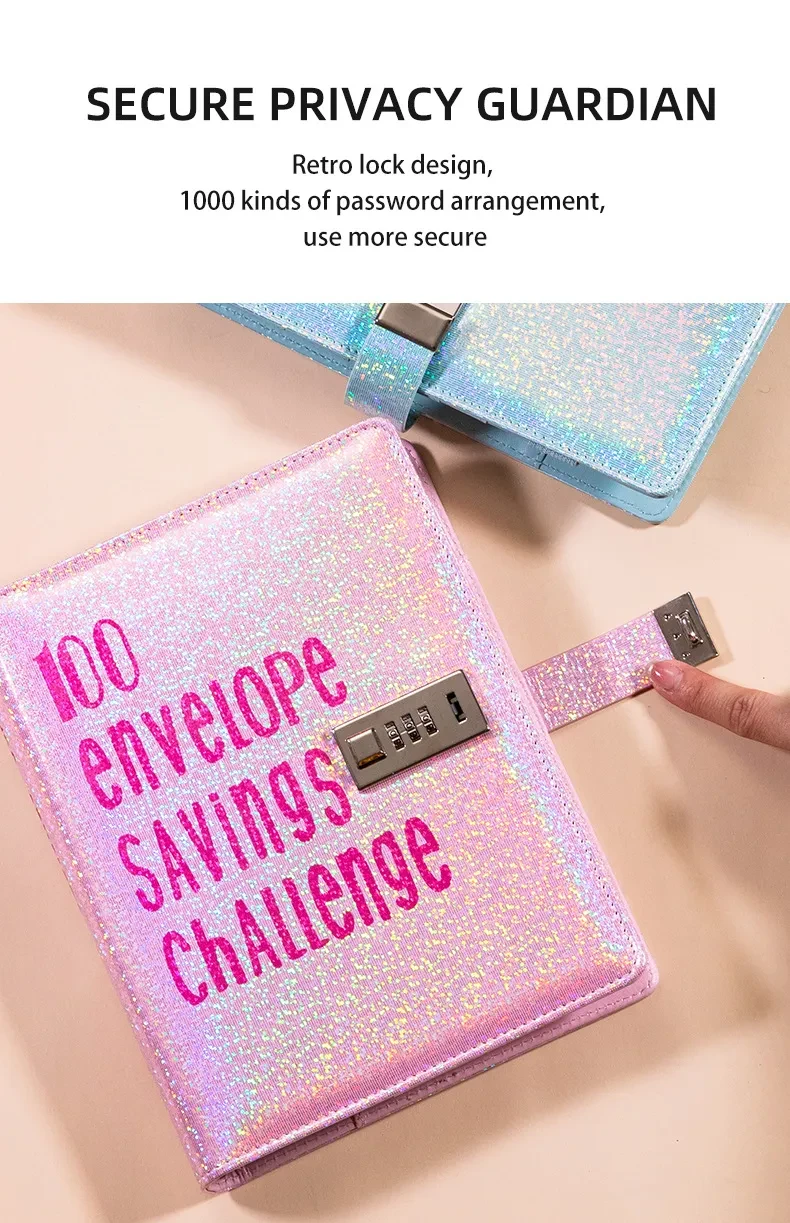

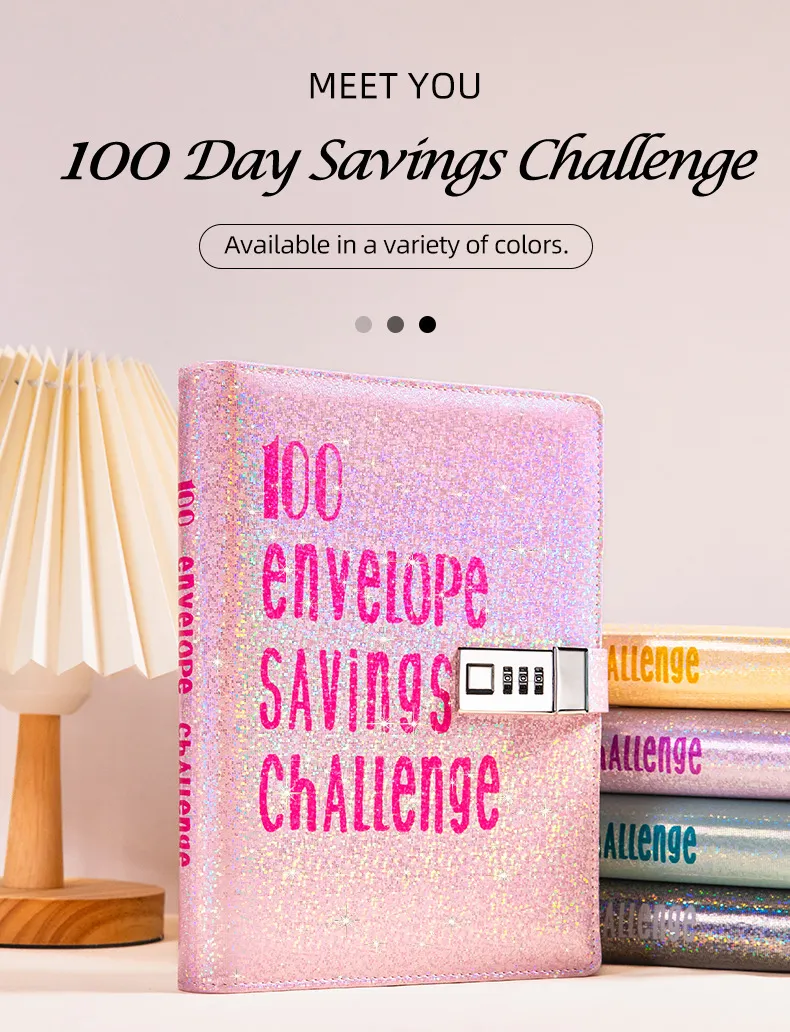

Model: 100-day money-saving challenge plan notebook loose-leaf

Style: Creative trend

Binding method: loose-leaf clip binding

Cover material: Imitation leather

Packaging type: Basic packaging

Applicable scenarios: General

Notepad category: General notebook

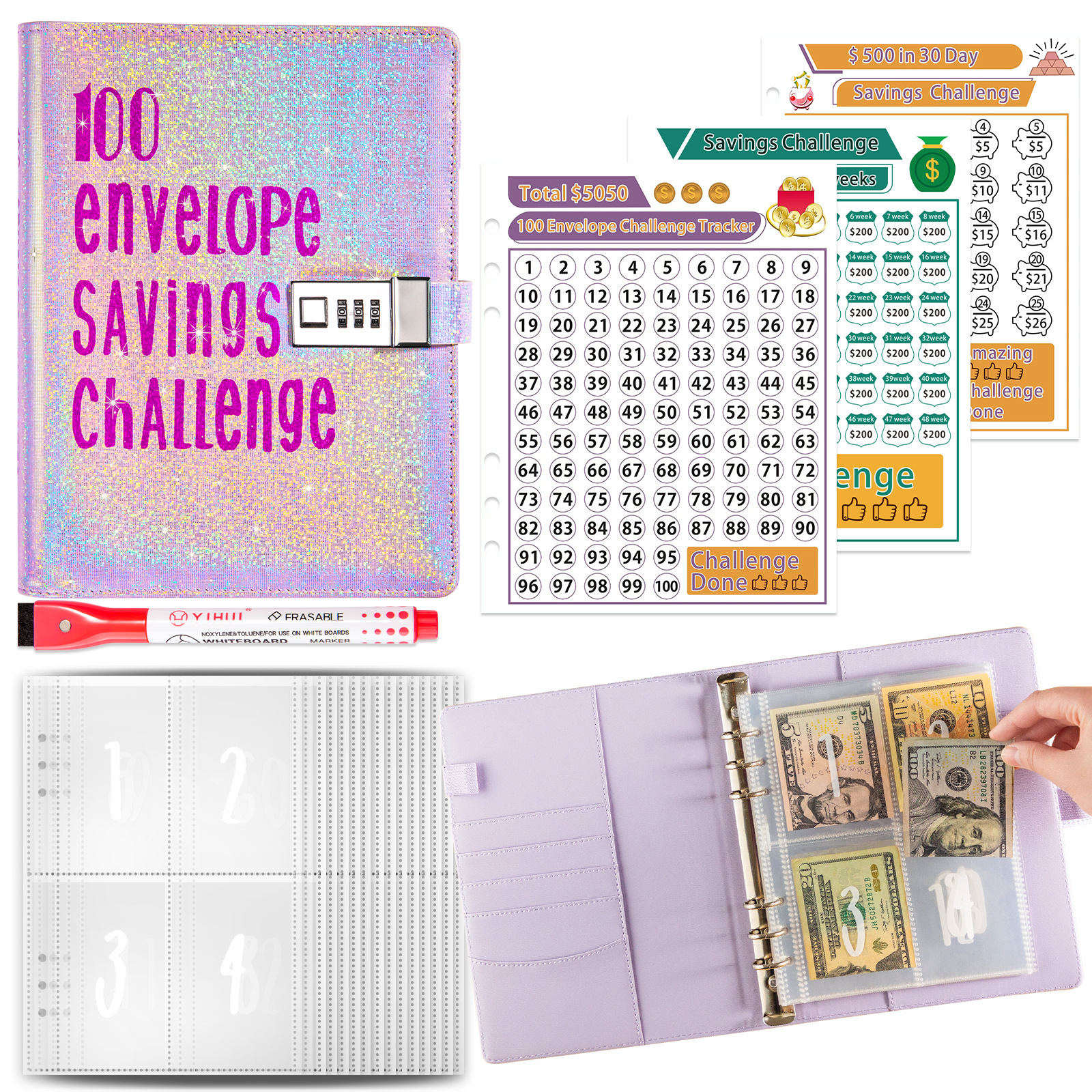

Color classification: A5 Password Lock Starry Sky High End - Purple (with lettering on the cover) (25 silk screen films (1-100)+3 all

series punch cards+1 whiteboard pen)

Packing list:

Notebook * 1 set

Money Saving Challenge: A Fun and Effective Way to Save for Your Goals

A Money Saving Challenge is an engaging and motivational way to help you achieve your financial goals. Whether you're saving for a holiday, a new home, or simply want to build an emergency fund, a money-saving challenge can keep you on track and encourage you to save more each day. By making saving money more enjoyable and rewarding, these challenges can help you build better financial habits and achieve your savings goals faster. Designed for individuals or families, money saving challenges are perfect for anyone looking to take control of their finances in New Zealand.

Key Features of a Money Saving Challenge

When selecting a money-saving challenge, it’s important to choose one that suits your financial goals, lifestyle, and motivation style. Here are the key features of an effective money-saving challenge:

-

Clear Goals and Milestones: A money-saving challenge typically involves setting clear savings goals, such as saving a

specific amount each week or month. This structure helps you stay motivated and focused on reaching your target, whether it’s a small

savings goal or something larger, like a holiday fund or home deposit.

-

Simple and Easy to Follow: Many money-saving challenges are easy to follow, making them accessible for everyone, even if

you're new to budgeting or saving. Challenges can be based on a daily, weekly, or monthly system, so you can choose one that fits your

lifestyle and spending habits.

-

Flexible and Customizable: Some money-saving challenges are customizable, allowing you to set your own savings targets

based on your income and financial situation. This flexibility ensures that you can create a challenge that works for your specific needs

and goals.

-

Motivational and Fun: Money-saving challenges often use gamification techniques to make saving feel like a fun game rather

than a daunting task. With rewards for milestones, tracking progress, and seeing your savings grow, these challenges keep you engaged and

motivated to continue saving.

-

Financial Education: In addition to saving money, many challenges teach valuable lessons in budgeting, planning, and

managing finances. This can help you gain better control over your finances, improve your money habits, and build long-term financial

stability.

Benefits of Participating in a Money Saving Challenge

Participating in a money-saving challenge can offer a range of financial benefits, making it an effective tool for building wealth and financial security. Here are the key benefits:

Helps You Reach Your Financial Goals Faster

By committing to a money-saving challenge, you are more likely to meet your financial goals. The structured approach and regular milestones make it easier to stay on track, ensuring that you build up savings over time.

Encourages Better Money Habits

A money-saving challenge encourages you to be more mindful of your spending and savings habits. By actively tracking your progress and setting aside money regularly, you start developing better money management habits that will benefit you long after the challenge is over.

Makes Saving More Fun and Rewarding

Saving money doesn’t have to feel like a chore. Money-saving challenges add an element of fun and excitement, especially when you see your savings growing and hit important milestones. By turning saving into a game, you can stay motivated and look forward to achieving your financial goals.

Builds Financial Discipline

Saving money can be challenging, especially when temptations arise. Money-saving challenges help you stick to a plan and maintain discipline in your spending. They encourage you to make small sacrifices that add up over time, teaching you the value of delayed gratification and helping you improve your overall financial discipline.

Provides a Sense of Accomplishment

There’s a sense of pride and accomplishment that comes with meeting your savings goals, whether it’s completing a 52-week challenge or saving for a big purchase. The challenge helps you track your progress, and seeing your savings grow brings a sense of achievement, reinforcing the habit of saving.

Why Choose a Money Saving Challenge in New Zealand?

A money saving challenge is the perfect way to take control of your finances and achieve your financial goals in New Zealand. Here’s why it’s a great fit for Kiwi residents:

-

Helps with Big Financial Goals: Whether you’re saving for a house deposit, a wedding, or a family holiday in New Zealand, a

money-saving challenge is an excellent tool to help you reach your target. The challenge provides structure and accountability, ensuring

that you stay on track for your big financial goals.

-

Ideal for Kiwi Families: Money-saving challenges are great for the whole family. By including your children in the process,

you can teach them about the importance of saving money and working towards goals. It’s a fantastic way to instil good financial habits in

the next generation.

-

Customizable to New Zealand’s Cost of Living: New Zealand’s cost of living can vary depending on the region, and

money-saving challenges are flexible enough to accommodate different financial situations. Whether you’re in Auckland, Wellington, or a

smaller town, you can adjust your savings goals to match your local expenses.

-

Encourages Local Travel and Experiences: With many New Zealanders using money-saving challenges to save for holidays, the

challenge helps you plan your dream getaway, whether it’s exploring the beaches of the Bay of Islands or hiking in the South Island. These

challenges help you set aside funds for local adventures and experiences.

-

Eco-friendly and Sustainable: Many New Zealanders are focused on sustainability and mindful spending. A money-saving

challenge encourages conscious consumerism, allowing you to save money while also being more intentional with your purchases.

Conclusion: Take Control of Your Finances with a Money Saving Challenge

A money-saving challenge is an engaging and practical way to help you reach your financial goals. By setting clear goals, staying motivated, and developing better money habits, you’ll not only achieve your savings targets but also improve your financial discipline. Whether you’re saving for something specific or simply want to build a better financial foundation, a money-saving challenge is the perfect solution to help you succeed.

Start your money-saving challenge today and begin building the savings you need for a brighter financial future in New Zealand!

The product may be provided by a different brand of comparable quality.

The actual product may vary slightly from the image shown.

Shop amazing plants at The Node – a top destination for plant lovers

.png)

.jpg)

.jpg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpg)

.jpeg)

.jpg)

ulva-Logo.jpg)

.jpeg)

.png)

.png)